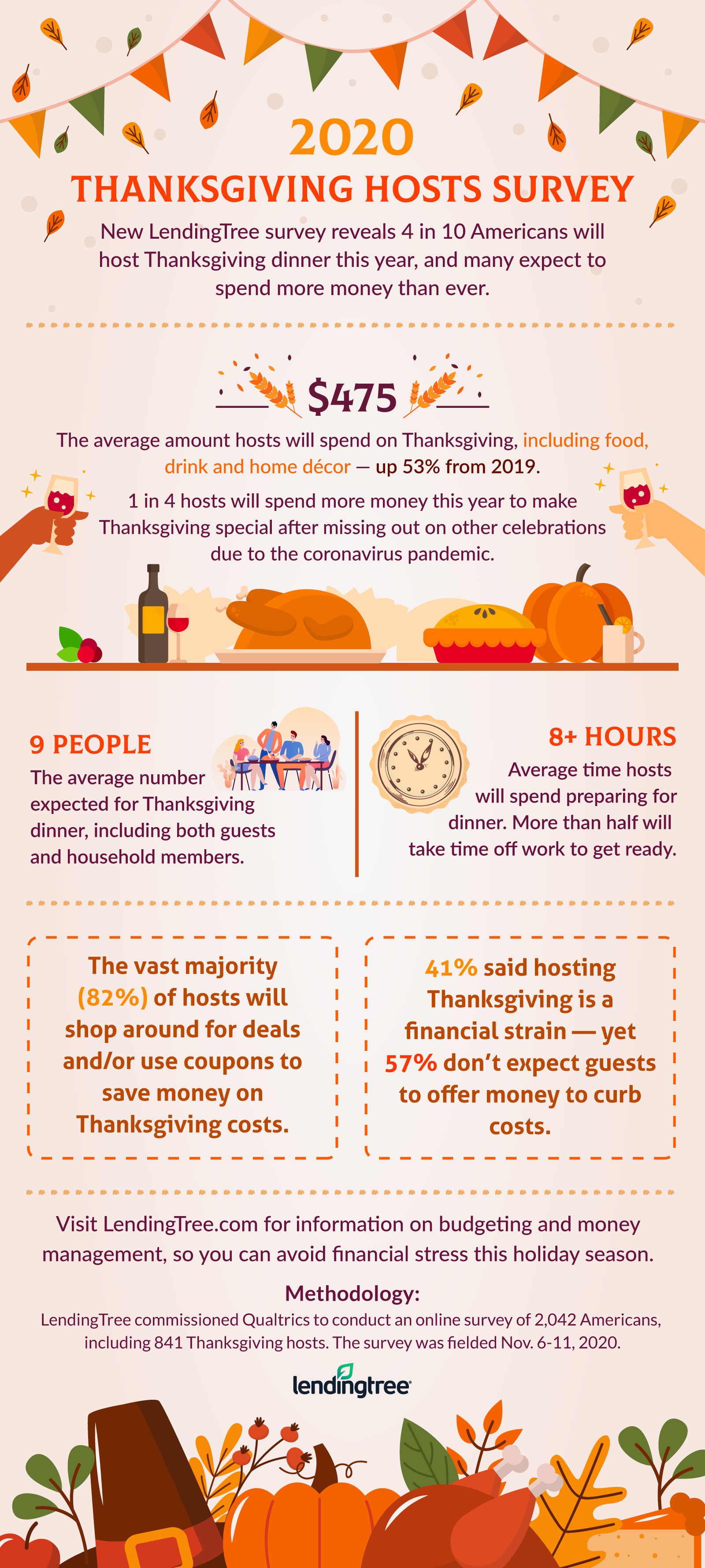

8+ loan to buy into partnership

Funds borrowed to purchase an interest in a. Asset based lender will usually.

Official Website Of The Berlin Tv Tower Enjoy The City From Above

Loans Up To 500k.

. The interest rate is based on the amount you want to borrow but the maximum lending amount is 5 million. Decisions within 48 hours. Ad Bid on Bigger Projects.

Ad Click Now Get the Best Rates for Business Loans. On National Fundings Website. You may need finance to buy asset or other business expenses.

You can use the SBA 7 a loan to help you cover the expenses associated with buying an existing business. Getting a loan to buy an existing business is possible with good credit solid business financials and a basic understanding of the lending process. Business Loans as secured or.

Do Business on Your Terms. Partner Buy InOut Funding. Start Understanding Your Goals Risks and Time Horizon.

A firms partnership agreement typically sets out the process to calculate a new partners buy-in amount. I believe it would be on Schedule E. Up to 5M as Fast as 24 hrs.

7 a loans are the most flexible and basic type of SBA loan. Funds within 48 hours of acceptance. Online business loans may offer more flexibility when it comes to qualification compared with bank and SBA loans.

1 Year In Business Monthly Revenue 10K Required. Evaluate your qualifications and understand what lenders are looking for. The perfect loan to buy the business youve been eying.

However a partnership in a field that doesnt generally engage in accepting or granting loans is. 3 month to 5 year. Come get your loan.

Using an SBA 504. A leveraged buyout can help you get into. B Investment interest on Schedule A after.

Ad Financing Up to 1M in as Little as 24 Hours - Get the Funding You Need Fast. View solution in original post. Apply today and get started.

The relief covers loans to. Is he A a managing partner of the business or B is it merely an investment interest. In many ways getting a loan to buy an established business is easier than getting a business startup loan.

SBA 7a loans have relatively low-interest rates though they are variable long repayment terms 10-25 years and can provide up to 5 million in capital. The new rules state that for partner buyouts the borrower does not need to put down any equity as long as the business has a debt-to-net-worth ratio of 91 or less. Get Control of Material Financing.

I have a bank loan to fund my partnership capital contribution. Simple Secure Application. Grow Your Business Now.

Commercial Loans Lines of Credit Available. Loans No Credit Check. Using an asset based loan to obtain financing is a way for companys with strong balance sheets or personal andor commercial real estate to obtain financing.

Up to 5M as Fast as 24 hrs. The SBA 504CDC loan can be ideal. In this guide we break down how to get a loan to buy a business in three steps.

Small Business Administration has fixed a rule that was threatening to make it extremely difficult to finance partnership buyout transactions using SBA -backed. Ad Click Now Get the Best Rates for Business Loans. Borrowing money from bank as a business loan is the best option for your finance needs.

Best Loan Options From More Lenders. The standard SBA 7 a loan can be a good option for partnerships that need working capital or want to expand or acquire a business. Over 250 funding lines.

Ad Get a Business Loan From The Top 7 Online Lenders. Connect With Top Lenders. The new partner buy-in amount is typically based on a proportion of the firms accrual.

Loans No Credit Check. Buy a share in a partnership contribute money to the partnership by way of capital or premium which is used for the purposes of a trade or profession carried on. Connect With Top Lenders.

Minimum credit score requirements can be as low as 600. Ad Financing for Equipment Business Acquisitions Leasehold Improvements More. Ad Buy a small business using the loan that most people dont know about.

Buying a business thats already established could allow you to walk into work with. A partnership firm in the financial services industry can make a loan to a sole proprietorship. Where do I deduct the interest I pay on this loan.

Or call us on. Ad At least 12 months in business monthly revenue of 20k. Turning Down Bigger Projects.

Ad An Exceptional Approach So That You Feel at Home. Get the Materials You Need When You Need Them.

Can Partnerships Have Shareholder Loans

B Side Capital Your Sba Lending Partner Since 1990

8 Key Clauses That Strengthen Business Partnership Agreements Free Premium Templates

3 Ways To Finance An Employee S Equity Purchase Alexander Business Law Pllc

Three Financing Options For New Partner Buy In Transactions

Working In Partnership To Develop The Skills Of Enterprise St Paul S School

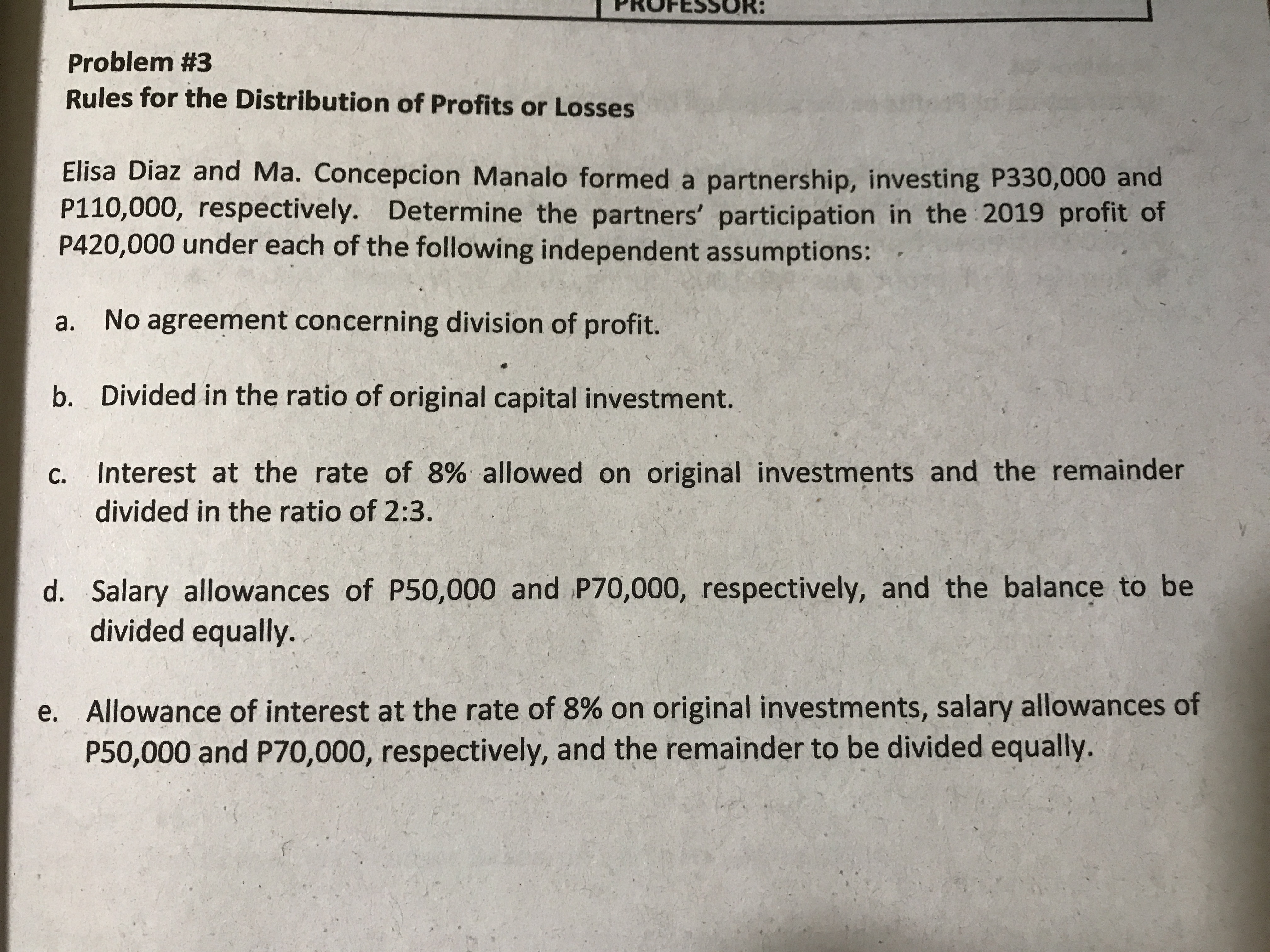

Answered Problem 3 Rules For The Distribution Bartleby

The Pros And Cons Of Partner Buyout Financing

Working In Partnership To Develop The Skills Of Enterprise St Paul S School

What Is The Most Guaranteed Way To Make Money Investing Long Term Quora

Porter Delivery Driver App Apps On Google Play

Free 9 Business Loan Proposal Samples In Pdf Ms Word

Balance Sheet Of Ram And Shyam Who Share Profits In Proportions To Their Capitals As At 31 St March 2018 Is Liabilities Rs Assets Rs Capital A Cs Ram 30 000shyam 25 000current A Cs Ram 2 000shyam 1 800creditorsbills Payable55 0003 80019 00016

X And Y Are Partners Sharing Profits And Losses Equally Their Balance Sheet As On 31st March 2018 Is Given Below Sarthaks Econnect Largest Online Education Community

Bank Partnership

How To Finance A Partnership Buyout Funding Circle

Back To School Is Made Easier Mhasibu Sacco Society Ltd Facebook